Maritime Observer Newsletter #9

Looking at what 2025 brings for the Middle East market, news of Saudi Arabia's NEOM, and updates on seized vessels in the EU and US.

Reader,

September 2024 went profitably by, marking the return of the boat show season opening triumvirate, Cannes Yachting Festival, Genoa Boat Show, and Monaco Yacht Show, where brands and companies from around the world congregated to take part. Several shipyards also took the opportunity to share their fiscal results, indicating the industry's strength at a time when the vagaries of political events happening around the world have affected the market.

During the Cannes Yacht Festival, Azimut-Benetti Group announced strong results for the 2023/24 fiscal year with a 55% revenue increase compared to four years ago, rising from €840 million in 2020/21 to €1.3 billion in 2023/24. Notably, the Middle East and Asia Pacific region accounted for 23% of total sales, an 8% increase from the 2020/21 period. Meanwhile, Dutch builder Heesen Yachts took to the Monaco Yacht Show to announce record revenues totaling €230 million for the 2023/24 year. Speaking to the press, CEO Niels Vaessen anticipated the role of Middle East clientele to take even more prominence in the coming years, noting: “We can see there is a lot of wealth in the traditional yachting markets [the US and Europe] and we expect those markets to be very stable in the coming years alongside a lot of growth in the Middle East"

The Middle East has indeed witnessed significant growth, and as a superyacht market, finds itself in a promising position as 2025 looms. Saudi Arabia’s highly anticipated developments NEOM and Amaala are set to usher in a new era of maritime tourism with their soft openings, as the Saudi Red Sea Authority recently released the first-ever regulations for cruising yachts in the Kingdom. With the infrastructure dedicated to establishing a thriving coastal tourism sector, The Kingdom plans to attract 19 million tourists by 2030.

The United Arab Emirates continues to prove itself as an established market. The Dubai International Boat Show, which returns from 19-23 February, broke records for its 30th edition when it welcomed over 30,000 visitors at Dubai Harbour. A high-demand area, the Emirate is addressing the shortage of berthing spots with the addition of new marinas, including D-Marin’s recently announced Port De La Mer. This is also evidenced when looking at domestic proprietorship. Observing the 40m+ segment when compared to the global fleet, the UAE saw an increase in superyacht ownership for the third consecutive year, occupying 3.7% of the total fleet, according to the Superyacht Times, Monaco Yacht Show Report 2024, while Saudi Arabia remained stable at 3.1%.

Meanwhile, a notable trend deduced from the figures reveals a drop in owners of Russian nationality by over 10% in the past 3 years, now accounting for 7.8% of the global fleet, compared to 9.1% in 2022. Certainly, the 2022 Russian invasion of Ukraine remains a prevalent issue that affects the superyacht market in many ways.

During the superyacht investor conference this past April, Paul Miller of Millstream Underwriting prognosticated that it would take between 8 to 10 years for sanctions issues coming out of the Russia-Ukraine war to be resolved. It seems as though we have started to see a semblance of that when the U.S. Department of Treasury announced it had removed the 136-meter superyacht Flying Fox from its sanctions list, permitting the vessel to be chartered globally without any restrictions. For now, the decision concerning Flying Fox remains an outlier as other vessels await to see their denouement. The 59-meter Phi remains docked at London’s Canary Wharf as her owner awaits a Supreme Court hearing, challenging the Appellate Court’s Decision from this past January. Meanwhile, the 82-meter Royal Romance, previously scheduled to be auctioned, after ownership was transferred to the Ukrainian Government, continues to face legal complications with her sale. The auction is now indefinitely suspended. Overall, it seems as though each of the concerned governments is handling the sanctions regulations in a different manner, and for the U.S., the issue of sanctions is one of several that concern the stability of the global market predicated on the upcoming Presidential Elections.

The U.S. Elections, having historically impacted the market, are causing reticence from buyers and sellers who await to find out who emerges victorious between Donald Trump and Kamala Harris this upcoming November. Although contrary to conventional wisdom, election years have not caused any negative implications on the market, as this piece from yachting firm IYC posits, as much as it is potential buyers who are adopting a “wait and see” approach that causes a stall.

Alongside the presidential elections and sanctions measures, the political situation in the area has arguably affected the region most directly, if only for its perception. This year, Egypt made a remarkable effort to invest in its nautical offerings when it turned the Suez Canal into more than just a transit area for superyachts - as I wrote back in July - despite the ongoing security issues permeating the Red Sea. The re-emergence of Houthi Attacks on commercial shipping vessels continues to affect the maritime industry as a whole, and apprehension preventing any superyacht owner from cruising a high-risk designated area is apparent, even galvanizing the Suez Canal to incentive movement in the area by introducing a 50% discount on transit fees to boost tourism. But as noted in the aforementioned piece, security concerns surrounding the Red Sea are only one part of the equation affecting marine tourism, saying less about the region but more about the current political landscape.

It remains to see what will happen, but if there is anything to takeaway from the events lined up in Abu Dhabi, Qatar, Egypt, and Dubai, there are no plans to slow down anytime soon. I look forward to chronicling all of the developments on maritimeobserver.com.

Note: This December, The SuperYacht Times will be hosting the 2024 edition of the Gulf Superyacht Summit in Dubai. The two-day summit dives into sharing insight on building the Gulf’s appeal as a superyacht destination, an event pertinent to readers of this newsletter. You can find more information here.

I would love to hear your thoughts. You can reach out to faisal@maritimeobserver.com

Wishing you a fantastic month,

Faisal

NEOM Announces Sindalah Yacht Club, Designed By Stefano Ricci

Saudi Arabia’s luxury development NEOM announced an upcoming yacht club for superyacht destination SINDALAH. Sindalah Yacht Club, with designs penned by Italian designer Stefano Ricci, spans 1,800 square meters and will also feature a lounge and an exclusive fine-dining experience curated by Chef Enrico Bartolini. Management of Sindalah Yacht Club will be overseen by IGY Marinas.

BWA Yachting Announces Expansion to Saudi Arabia

Superyacht services agency BWA Yachting is expanding over to the other side of the Red Sea

The global agency announced it will be operating in the Kingdom of Saudi Arabia, in partnership with Faisal M. Higgi & Associates Co. Ltd, a port agency specializing in cargo handling, customs clearance, and port agency services.

MarineMax Appoints Steven English as Chief Executive Officer of IGY Marinas

IGY Marinas, a subsidiary of superyacht services company MarineMax, appointed Steven English as Chief Executive Officer.

English joined IGY in 2007 as Executive Vice President overseeing dispositions and joint ventures in marinas across Europe and the Middle East, before transitioning to the role of Executive Vice President when IGY was acquired by MarineMax from Island Capital Group in October 2022.

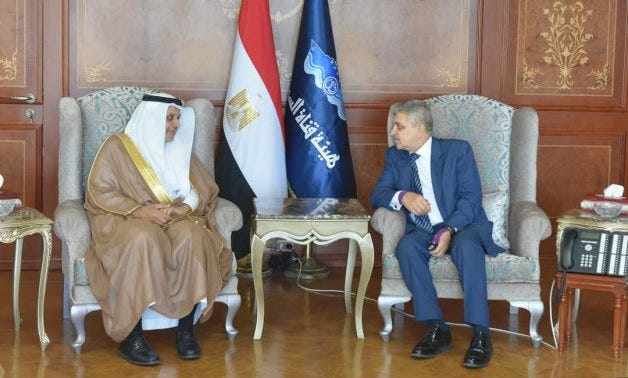

Egypt and Saudi Arabia Officials Meet to Promote Red Sea Tourism

Last week, Suez Canal Authority Chairman Osama Rabie and Saudi Vice Minister of Transport and Logistic Services H.E. Rumaih Al-Rumaih, accompanied by a distinguished delegation, met in Egypt to facilitate discussions around enhancing collaboration between Saudi Arabia and Egypt in areas pertaining to maritime tourism, facilitating entries of yachts and cruise ships, and easing navigations of key Red Sea projects.

Saudi Red Sea Authority and ICOMIA Form Partnership to Boost Superyacht Tourism in the Red Sea

The Saudi Red Sea Authority (SRSA) and The International Council of Marine Industry Associations (ICOMIA) have agreed on a new strategic alliance in an effort to boost the region’s coastal tourism sector.

Through the newly formed partnership, ICOMIA plans to work toward this goal with SRSA by establishing connections with the global recreation boating industry, providing technical insight, and offering access to specialist training and development.

136-Meter Superyacht Flying Fox No Longer Placed Under Sanctions by the US; Available for Charter Globally

The US Office of Foreign Assets Control has removed Flying Fox, the 136-meter superyacht, from its sanctions list. This move now allows the superyacht to be chartered without any restrictions imposed.

In June 2022, the Lürssen-built vessel was listed as blocked property by the US Department of Treasury, following the 2022 Russian invasion of Ukraine, due to the yacht’s link to its management, Monaco-based brokerage firm Imperial Yachts.

M/Y Meridian A to Remain Seized by Spanish Authorities after EU Court Rejects Appeal For Annulment

The 85-meter motor yacht Meridian A to remain under arrest by Spanish Authorities after the EU Court rejected an appeal for annulment for Council Decision (CFSP) 2023/1767 of 13 September 2023.

For the first time since 2022, an update has been given on the status of M/Y Meridian A, as first reported by Superyacht News. A new ruling by the European Union’s General Court rejected an appeal brought by Sulberg Services, a company based in the British Virgin Islands, to repeal the decision taken at the time of the vessel’s seizure.

Known as Valerie at the time of arrest, Meridian A was one of the first vessels to be arrested in 2022 following the Russian Invasion of Ukraine. She was seized by the Spanish Authorities as it was gearing up to undergo a refit at MB92 Barcelona after being linked to Sergey Chemezov, CEO of Russian state-owned defense conglomerate Rostec. The yacht’s registered ownership belongs to British Virgin Islands company Sulberg Services, with Chemezov’s daughter-in-law Anastasia Ignatova being identified as the ultimate beneficiary.

The Italian Sea Group Refute £186m Legal Filing Against Crew and Widow of Bayesian Superyacht Owner Mike Lynch

On Saturday, September 21st, Italian newspaper La Nazione reported news of a representative for the Italian Sea Group filing documents in a Sicilian Court on Friday against the crew and widow of Bayesian superyacht owner Mike Lynch. The Italian builder reportedly sought legal damages of up to £186 million, citing reputational damage and loss of earnings due to the incident